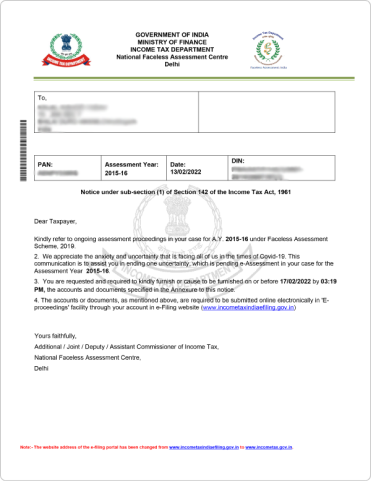

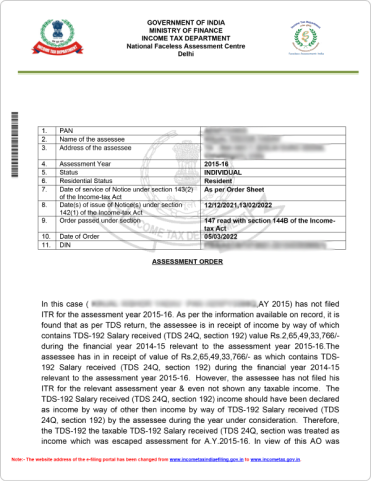

Issued when the Assessing Officer (AO) requires additional information or documents to complete the assessment. This notice may also be sent if you haven't filed your return on time.

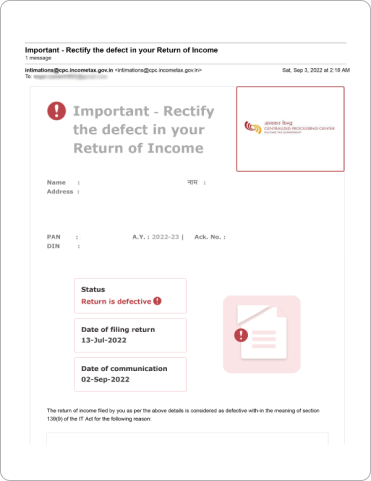

Read MoreServed when your filed return is considered defective due to missing information or incorrect details. You have 15 days from the date of receiving the notice to rectify the defects.

Read MoreSent if the AO believes that some income has escaped assessment. This notice requires you to file a return for the relevant assessment year.

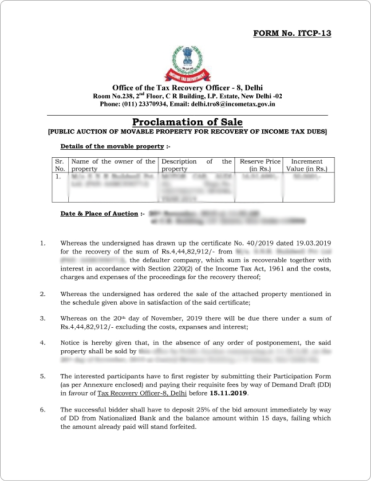

Read MoreIssued when there's a tax liability, penalty, or interest payable by you. The notice specifies the amount due and the deadline for payment.

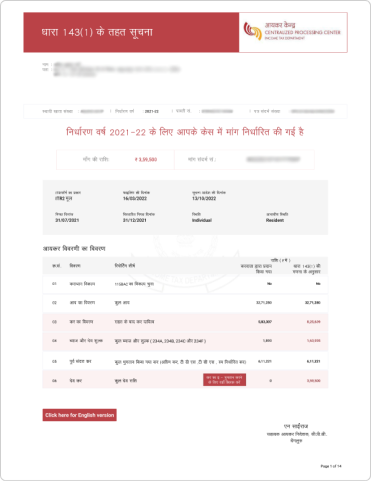

Read MoreAn automated intimation sent after processing your return, highlighting any discrepancies between your filed return and the department's calculations.

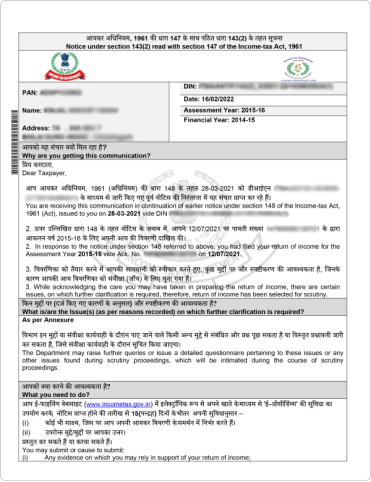

Read MoreIndicates that your return has been selected for detailed scrutiny to verify the correctness of the return filed.

Read MoreEmpowers the AO to summon individuals for evidence or documents during proceedings, especially if there's suspicion of income concealment.

Read MoreIssued when the department plans to adjust your refund against any outstanding tax liability from previous years.

Read MoreNeglecting an income tax notice can lead to:

Failing to respond to an income tax notice can lead to significant legal and financial repercussions under the Indian Income Tax Act. Here's what you need to know:

If you receive a notice under Section 139(9) for a defective return and fail to rectify the issues within the stipulated time (usually 15 days), your return may be treated as invalid. Consequences include:

Non-compliance with notices under various sections can result in increased tax liabilities:

Under Section 234A, a delay in filing returns attracts interest at 1% per month on the outstanding tax amount. This interest is calculated from the due date until the actual filing date.

In severe cases, especially involving willful tax evasion, the Income Tax Department may initiate prosecution proceedings. Penalties can include:

Ignoring tax notices can tarnish your financial credibility, affecting loan approvals, visa applications, and other financial transactions.

Responding to an income tax notice requires submitting relevant documents based on the type of notice issued by the Income Tax Department. However, some documents are commonly required across most notices. These include:

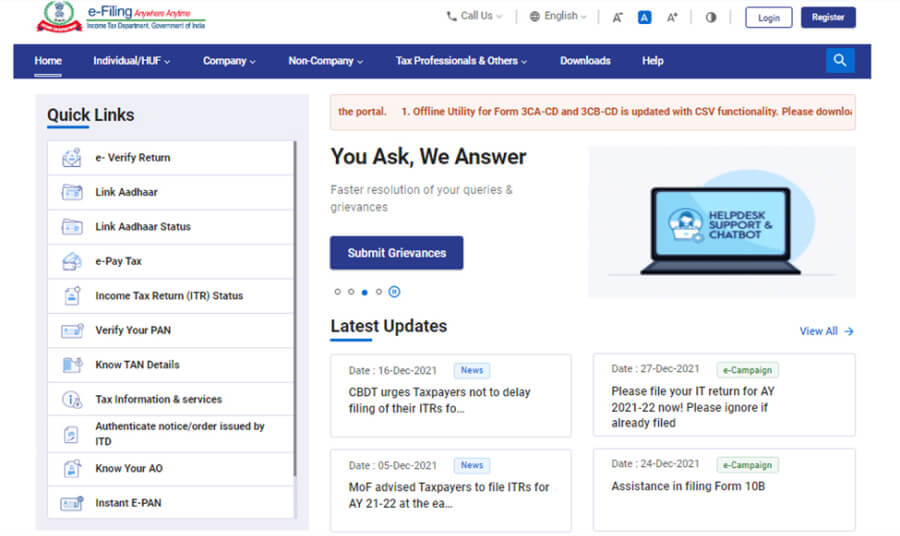

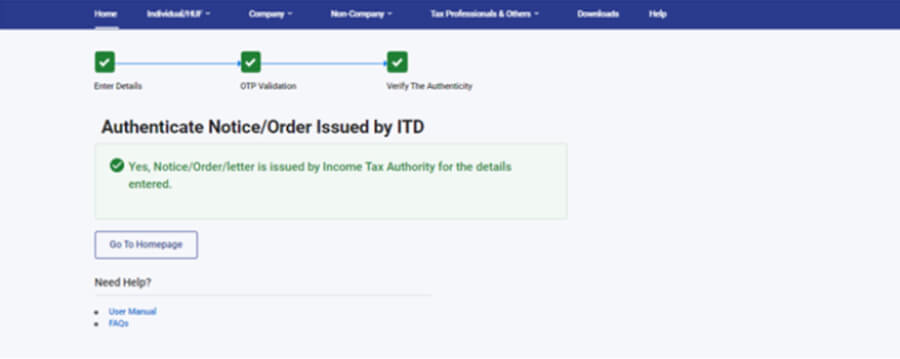

Before responding to any income tax notice or order, it is important to verify its authenticity. The Income Tax Department allows taxpayers to authenticate such communications online through its official portal.

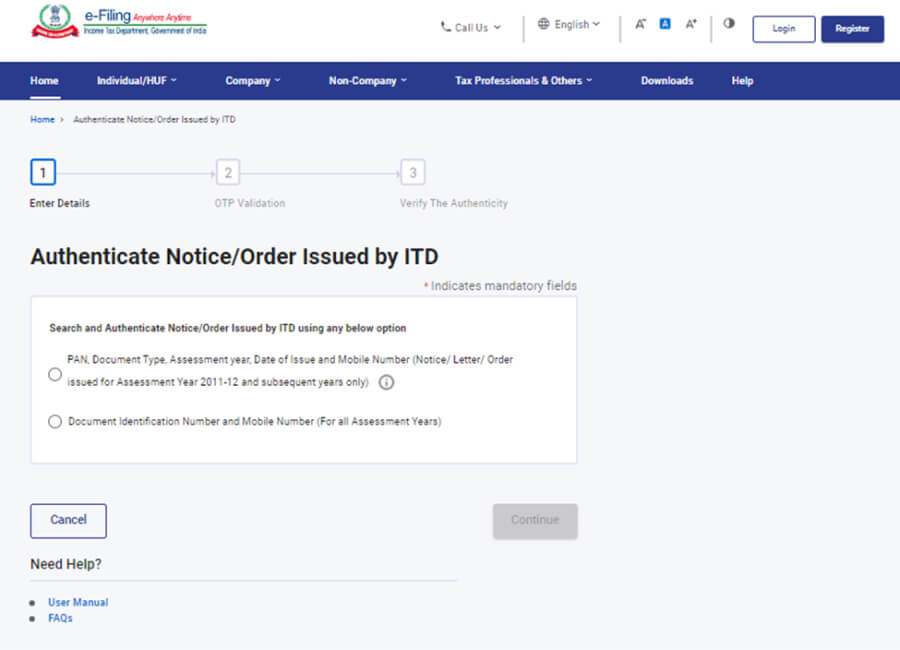

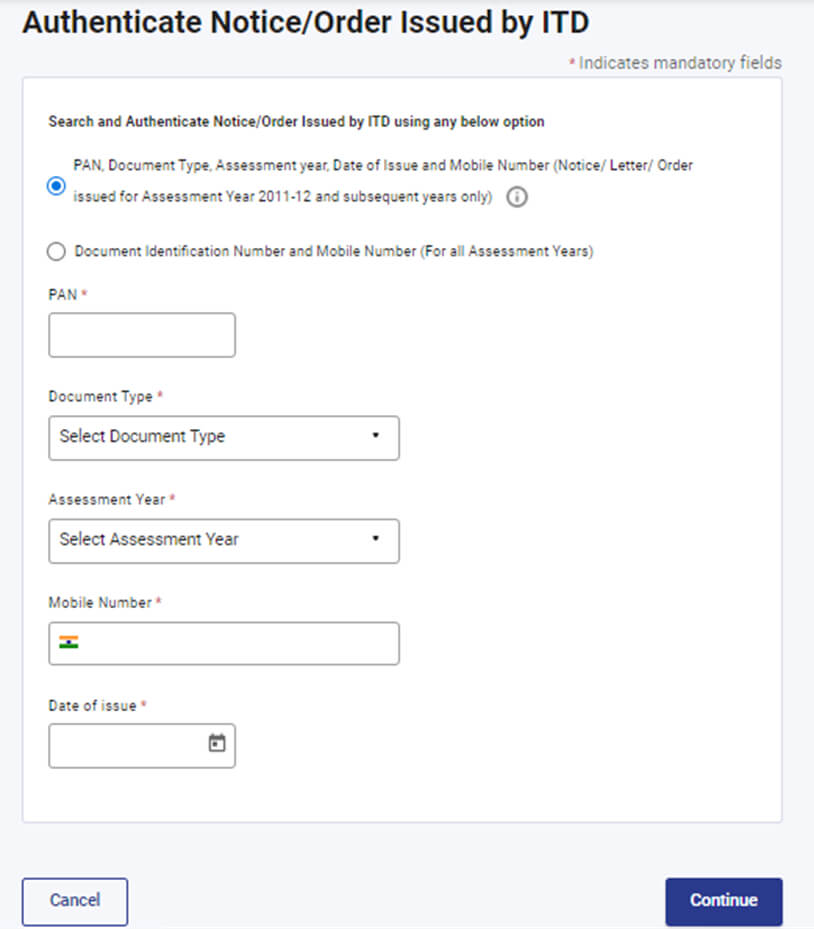

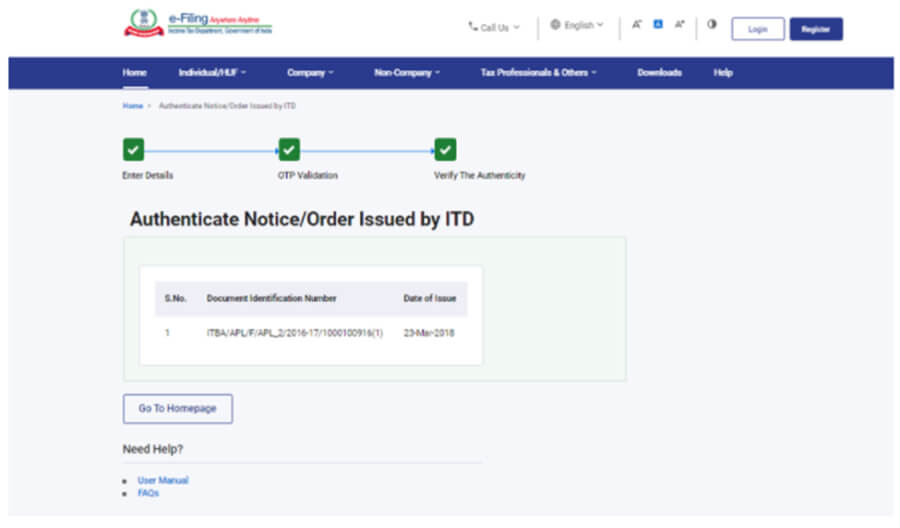

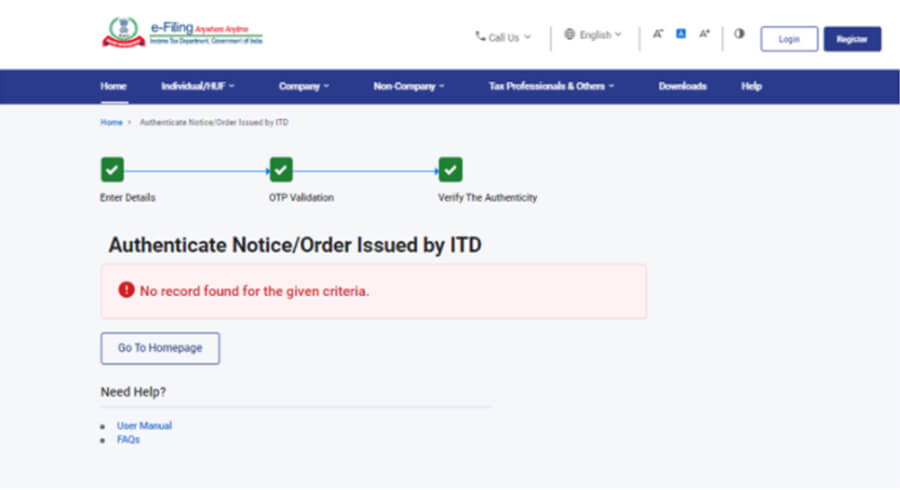

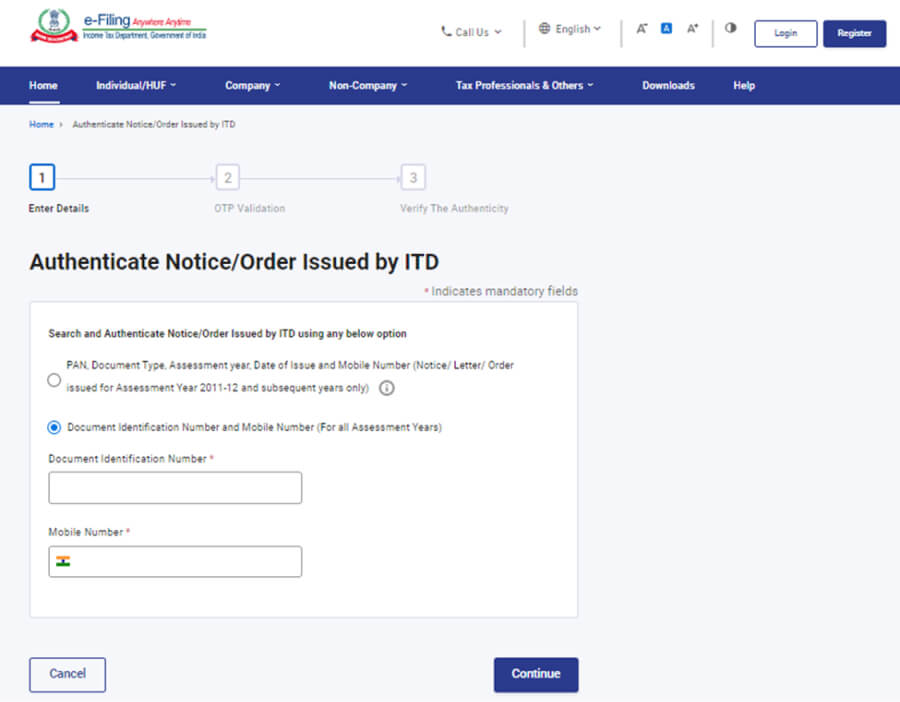

Follow these 6 easy steps to authenticate a notice or order issued by ITD:

You can verify your notice using the following details:

If you already have the DIN, you can choose to authenticate using:

Receiving an income tax notice may initially seem overwhelming, but with the right knowledge and approach, you can effectively manage it. Remember, timely and accurate responses are key. By checking and authenticating income tax notices online, you can verify their legitimacy and take the necessary steps to address any issues or discrepancies.

Once you have checked the income tax notice online, remember to respond within the time frame mentioned in the notice. taxesgenie tax experts can help you respond to and resolve income tax notices timely and accurately. Talk to the experts today.

An Income Tax Issue Letter is a formal communication from the Income Tax Department to the taxpayer. These notices are typically sent for reasons such as non-filing of returns, discrepancies in filed returns, or requests for additional information. They are issued to ensure compliance and maintain transparency in the tax system.

The code EXC-001 indicates a transaction that exceeds permissible limits under the Income Tax Act—commonly related to cash deposits exceeding ₹10 lakh in a month.

Yes, salaried individuals can receive notices. Most commonly, they receive Intimation under Section 143(1). However, notices may also be issued for concealed income or discrepancies in filings.

You can:

Yes, you may receive a notice for current account transactions, especially if the aggregate amount exceeds ₹50 lakh in a financial year. Such high-value transactions must be reported and can attract scrutiny if not declared.

This refers to a proposed adjustment by the IT Department against your refund claim due to errors such as:

It may also relate to previous outstanding tax demands.

If the discrepancy is valid, you must pay the demanded tax. If the discrepancy is due to an error, you can file a rectification request under Section 154:

Notices under Section 143(2) (for scrutiny) can be issued up to 6 months from the end of the financial year in which the return was filed.

Ignoring a notice can lead to serious consequences:

It is a system-generated notice that compares your filed return with the records of the IT Department. It is issued within one year from the end of the financial year in which the return is filed.

The Income Tax Department may proceed with adjustments based on the information it holds, including recovery from any refund claimed, without further intimation.

Your ITR-V is sent to your registered email once you file your ITR. You can also download it by logging into the e-filing portal under My Account → View Returns/Forms.

Authenticating ensures the notice/order is genuine. Use the "Authenticate Notice/Order issued by ITD" tool on the income tax portal to verify details like DIN, PAN, and assessment year.